Monsoon session of parliament has been a big disappointment. CAG report on “Coalgate” has had ripple effects in the political fraternity and the opposition sensed the opportunity to disrupt the smooth functioning of the parliament. Opposition is becoming adamant to seek PM’s resignation and cancellation of 142 coal blocks granted during the UPA regime. At a time when GDP has slipped below historical trend and industries are looking up to the government for supportive policy framework, oppositions are busy alleging the ruling government for unethical practices and UPA-2 is busy defending themselves and this is creating a nasty picture of the political system prevailing in the country.

India is struggling hard to fix the domestic political deadlock and in the process loosing focus on the greater economic agenda of bringing in a better policy framework and reforms so as to arrest the slide in GDP. If such condition prevails, this will have serious implications for India’s rating in global landscape. Indian rating downgrade will make us starve for capital and the economic slowdown would further intensify on lack of conducive investment climate and perilous foreign capital inflows.

Markets for the month of August have done better despite of the political logjam. Though at the fag-end it started losing grounds as the political crisis intensifies in the country. Banking sector and mid-cap stocks were the major underperformer. In recent times, quality management and lower leveraged companies with good cash flows are the only stocks which continue to outperform the broader indices. Any stocks with a smack of bad governance is being thrashed down and these days the quantum of such news flow and incident has increased and people who gravitates towards the low quality midcap stocks are at the receiving end.

Emerging markets at present seems to be preparing ground and are holding resilient on expectation of QE3 from the US Federal Reserve before the presidential elections. If this were to happen, it’s going to spark another round of rally in all asset classes and primarily the riskier assets of the emerging markets would generate greater returns as liquidity comes here in hoard to seek alpha.

MSCI emerging market index performance on last two occasion of Quantitative easing by the Fed during 2008 to 2011 has been stellar. US central bank purchased $2.3 trillion worth of mortgage and treasury debt to cap borrowing cost. Developing-nation equities jumped 80 percent in the first QE period from December 2008 to March 2010, while developed-market stocks rose 35 percent. The emerging-markets gauge rose 19 percent in the second QE period between August 2010 and June 2011, and dropped by an average of 9.6 percent after QE1 and QE2. So this time as well, QE3 will stoke asset price bubble but the quantum of the rise is incrementally receding. BRIC nation have outperformed in preceding QE regime and hence the leap forward could supersede the global rally this time as well. 12th & 13th of September is scheduled for FOMC meet and probably some indications from Mr Bernanke would be awaited by that time.

Earlier indications are for a risk-on rally building up is indicative by the fact that the dollar index is weakening against major currencies and gold again breaking out of its consolidation groove.

Gold bought through exchange-traded products (ETP) backed by yellow metal has been on a rise and ETP is among the fourth largest hoard of gold compared with national reserves, ahead of France. Investors in ETP now holds 78.37 million ounce. Gold for this year has rallied 5% since January (still 15% lower than its previous high of $1921.15 made in September’2011) on European crisis and expected liquidity release from LTRO and QE programme is pushing the precious yellow metal prices higher. It is still perceived as a safe investment destination. Billionaire John Paulson raised his stake in the biggest bullion ETP by 26% in the second quarter and Geroge Soros more than doubled his holding according to latest filling in Aug. 14.

This month, again we have seen companies with higher debt and low interest coverage ratio getting battered down ruthlessly. Generally people tend to flock to companies which have gone down significantly from their all time highs and the interesting part is that the bears are still smelling dooms day for companies which are highly leveraged and facing hurdles in servicing their debt. So no price seems to be too low for them to sell. One era of bull market in Infrastructure story of India seems to be dying a natural death and stock rallies find sellers at every higher prices where people are stuck and are waiting to bailout. Many of the companies who are highly leveraged are now willing to sell their assets so as to deleverage their balance sheet. But the interesting part is that they are increasingly finding difficulty to attract buyers at a desired price. Probably fire-sell of productive long term assets at abnormally low prices will only dilute shareholders value significantly. We have tried to filter stocks with high debt/equity ratio and low interest coverage ratio and the most alarming and noticeable part is the fact that highly leverage companies are the biggest underperformer with an average decline of 75% from their all time high and 38% decline from 52 week high. Though, some of the prominent debt-laden companies are down more than 90% from their all time high and are in no mood to recover their lost ground because of obvious reasons. Once, considered to be the emerging mid to large cap stocks now deserve to be called the penny stock and probably some of them will vanish in thin air with the passage of time. Financial institutions who have lend money is now moving closer to a period when they will have no choice except to declare NPA’s for these debt-laden companies.

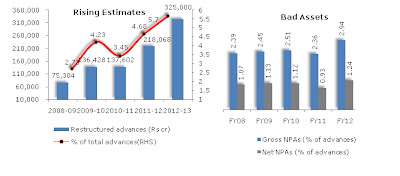

One most important and critical aspect of the high debt of inefficient corporate is the fact that ultimately the strain is going to be percolating down to the banking sector. Companies who are at extreme cash flow strain because of economic slowdown, improper execution of projects, higher interest cost, inability to raise adequate equity in a timely manner is further straining the balance sheets and financial flexibility of debt laden companies and finally they are approaching to banks for debt restructuring. These restructuring doesn’t reflect in the NPL’s and looking at current economic and political regime, it seems that many of them will come into NPA’s going forward and estimates are to the tune of 50bps to 75bps i.e, Rs 50000 crores of restructured assets turning NPA’s beyond March-2013. A current statistics indicates that the restructuring of assets by banks will jump by 63% from Rs 2 lac crores to Rs 3.5 lac crores in which Rs 1.60 lac crores is with SEB’s which are government guaranteed. Already Rs 1.6lac crores has already been restructured in 2011-2012. Estimates are for a 5.70% of total advances of banks will be restructuring quantum for this year and Gross NPA’s will be 3.5% for this year which looks scary at a time when GDP already has slipped from 9% to around 5% in couple of

*Source: Crisil Estimates and RBI

For this month, 14th September we will get the monthly Inflation numbers, FOMC FED meeting scheduled on 12th & 13th September’ 2012 and after that on 17th September, RBI Monetary Policy would set the tone of the market. Germany is also going to vote for ESM. An event heavy month and market will swing to the tune of the data flow. The biggest market mover would be the expectation of a QE3 and if the market doesn’t get any indication from the FED about it in September, it would threaten to fall. In any case QE3 would be the outcome before the Presidential elections in US because of political reasons and markets to remain resilient before the event.