Belaying RBI

The

rupee has been lamenting in the last few days and so has been everyone affected

by it. Rising prices and the falling rupee has combined to make a volatile

cocktail, exploding on the common man's face and giving the most nightmarish experience

of daily living. Rupee has seen a drastic downward trend in the last couple of

months, moving from bad to worse; it saw a life time low to 61.21 against

dollar after the better than expected US jobs data raised anticipation of

monetary tapering soon. Strengthening of dollar index

overseas, strong importers demand, continuous capital outflows coupled with

widening current account deficit has put pressure on the rupee. The over

13% depreciation of the rupee from the beginning of April has the markets jittery

and the government worried. The sole supplier of money is trying all possible

ways trying to save its product. The last month saw various actions by the RBI.

The life time low of rupee prompted immediate action by the

RBI to ban all

proprietary trading in currency futures and options by authorized dealer banks

with immediate effect. While the RBI has barred authorized dealer banks from

trading in currency futures and options (F&O) on their own, they will,

however, be allowed to trade on behalf of their clients. The central bank also asked oil firms to buy dollars

from a single bank to curb bunched up demand. July 15th

however saw major reform actions from the RBI front to prevent the clamp of the

rupee from reaching the psychological dread figure of 60.These actions included

the following:

>The central bank restricted banks'

borrowing through LAF (liquidity adjustment facility) to 1% of total demand and

time deposits or Rs 75,000 crore, whichever is less. LAF is the combination of

two auction routes: repo and reverse repo. While banks borrow from repo

currently at 7.25 percent, they park their excess liquidity via reverse repo

rate at 6.25 percent.

>MSF (marginal standing facility) rate

increased 200 basis points to 10.25% from 8.25%, i.e, 300 basis points higher

than the repo rate. It is the rate at which banks can borrow money from the RBI

pledging extra SLR bonds (the SLR rate is at present 23%).

>OMO (open market operation) sales of

12,000 cr. on July 18th.

The

open market operation sale of bonds however, remained an unsuccessful paradigm.

Much below the objective target, the Reserve Bank of India raised only

Rs. 2,532 crore through the open market operation bond sale on 18th July,

against the targeted Rs. 12,000 crore. The primary reason for RBI to not

accept all bids for sale despite its objective to curb excess liquidity in the

system was the uncomfortable nosedive in rates which would hurt investor

sentiments adversely.

A Step Ahead

Actions

undertaken seemed impotent and rupee still hovered around the 60 mark, more

from the RBI end was required to defend the currency, further actions by the

RBI on July 23rd were as follows:

- RBI reduced the liquidity adjustment facility (LAF) for each bank from 1%of the total deposits to 0.5%, thus limiting the access to borrowed funds from the central bank with immediate effect. The earlier imposed cap on overall allocation of funds at Rs 75,000 crore under LAF stands withdrawn. For the system as a whole, 0.5 percent of total deposits mean Rs 37,000 crore.

- RBI has also asked banks to maintain higher average CRR (cash reserve ratio) of 99%of the requirement on daily basis as against earlier 70%. CRR is portion of deposits that banks are required to keep with RBI.

- RBI also capped the total amount of funds available to a standalone Primary Dealer under LAF at 100% of the individual PD's net owned funds as per the latest audited balance sheet.

With all these measures, the central bank will continue to

closely monitor the markets, the liquidity situation and the macroeconomic developments.

It will take similar measures as necessary, consistent with the

growth-inflation dynamics and macroeconomic stability, said RBI, which further

announced its first quarter (April-June 2013) monetary policy on July 31, 2013.This

monetary review was marked by unchanged key rates as was expected by the

markets. The Governor justified RBI’s stance by mentioning that there could

have been monetary easing considering decelerating growth and a better

inflation numbers but since the primary focus at the moment was exchange rate

volatility, a STATUS QUO was preferred.

Were

the liquidity curbs effective?

The question that now arises is that whether

these measures were effective, and if they were what would have been their

consequences:

- The benchmark 10-year bond yield hit a 14-month high of 8.50%, up 33 basis points on the day and 95 basis points since the RBI's first round of measures on July 15.

- The one-year overnight swap rate jumped to 9.30%, it’s highest since September 2008 when the collapse of Lehman Brothers was roiling global markets.

- Short-term debt markets issues, particularly commercial paper with tenors of up to 3 months have surged 200 basis points.

- Following the RBI's second round of measures, the rupee gained 65 paisa to 59.11 in late following day trade at the Interbank Foreign Exchange market.

- Bank stocks got pounded and they took down with them the Nifty and the Sensex. As on July 24th, Nifty closed 1.44% lower and Sensex closed 1.04% lower, down by 87 and 211 points respectively.

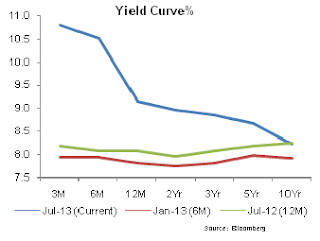

The graphs

below clearly show that the last few actions of the RBI have caused the

interest rates (both in the government securities market and the swap rate) to

rise. Also, as shown in the graphical representation, these liquidity

restraining measures have given a bit of relief to the rupee which before these

actions was depreciating abominably, but is still far from comfortable or

better said affordable range

A typical Yield Curve

An unusual yield curve is seen in the current scenario (blue line

in the graph below)-Inverted yield curve, a situation when short-term interest

rates are higher than long-term rates. Recent actions by the RBI have surged the

short term yields, the 3 month and 6 month yield have risen to 10.8% and 10.2%

respectively as on July 25th 2013. Under unusual circumstances,

long-term investors will settle for lower yields now if they think the economy

will slow or even decline in the future. An inverted yield curve can indicate

an unhealthy economy, marked by high inflation and low levels of confidence.

Debt Mutual Funds Affected

Mutual

funds are bracing for a fresh round of redemptions from their fixed income

schemes after the liquidity tightening measures to contain excessive

speculation in the rupee. Mutual fund officials are expecting outflows from

most debt schemes, a category which has seen sizeable inflows in last few

months. The mid month liquidity measures of the RBI resulted in the redemption

of about Rs. 60000-70000 crore. On July 16th, Mutual funds faced one

of the highest single day outflows since October 2008.The second round of

liquidity measures has, however, seen less redemptions (roughly about Rs.25000

Crores) because either a large chunk of outflows from debt schemes had already

taken place or that people started believing the RBI measures as a short term

phenomenon. Notably, RBI’s special liquidity 3 day window which allows banks to

borrow a total of Rs. 25000 crore at 10.25% was not used, reasons cited were

that they posited enough liquidity. But the more convincing reason can be that the

banks are finding the borrowing cost of 10.25% too high.

So, is it enough?

Apart

from the currency problem that is clouting RBI to monetary tightening actions, there’s

a continuous pinch from the fiscal arm too. Fiscal deficit occurs when the government

spends more than it earns and to fill the gap of budget deficit, one of the

measures used by the RBI is sale of bonds. The fiscal target for this year has been

4.8% of the GDP (5050.24 billion rupees), more than 30% (1807 million rupees)

of which has already been breached in the first two months. So, a further

growth sacrificing and increasing interest rate phenomenon seems in store from

the fiscal perspective too.

It is clear from the string of recent measures

that the government does not want the currency to be trading meaningfully above

60.The biggest question

that now arises is whether these actions are temporary. If the RBI is trying to achieve medium term

currency stability then these measures are going to last for a while but if it

is just about a shock therapy to cleanse up the system or if they believe that

there are speculative positions in the system which will get cleaned up through

this measure then it could be a relatively temporary measure and in that sense

lending and deposit rates might not go up substantially. Unless a country has a

relatively stable exchange rate it is very difficult to convince FDI’s and

FII’s to invest in India. It can be concluded that these measures have been the

ventilator and unless structural recovery takes place, it will be difficult for

the financial life in the form of investor confidence to sustain.