Highly speculated US Federal Reserve is finally putting an end to uncertainties surrounding the Federal Reserve action. Though the anticipated quantum of the tapering was to the extent of USD5 billion has been exceeded with and now it stands at USD 10 billion. The reasons for the action is well justified with the fact that US economic recovery seems stronger and the recent GDP data and other data like the unemployment and inflation data reflects a resilient recovery in the economy. Though, Janet Yellen seems quite savvy in dissipating the QE reversal with a caveat that the whole quantitative easing policy withdrawal hinges on the kind of recovery they see in the economy.

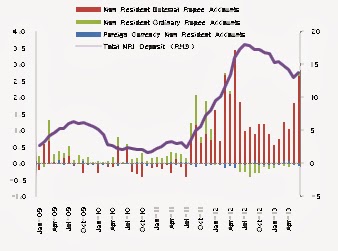

Emerging market like India were eyeing the Fed action with a hawkish eye as the general perception remains that the stimulus withdrawal and its quantum will decide the foreign money flowing into Indian shores and equities and also its effect on Current account deficit (CAD) and currency. The announcement as of yet didn’t have any meaningful impact on the currency per se, which is the immediate indicator of the kind of impact it could have on Indian economy. More so, the credit goes to Raghuram Rajan, for taking charge at the helm of RBI and since then adopting measures and steps which not only controlled the rowdy INR at that point in time but also brought in fundamental changes in India’s macro picture by reining in the boisterous CAD. The data in table below gives a clearer picture of the material changes happened in the past couple of months.

This has been a major reason for the market not reacting to the taper news in a jiffy. The general conclusion of a QE”s gradual winding going forward would be the USD strengthening, long-term real interest rates in US becoming more attractive and CAD deficit countries to see their currencies depreciating against USD. It all depends on how swift the FED wants the withdrawal to take place and how the economic data pans out. But the general trend should be one of a strong US market and weaker emerging market currencies, till the time they don’t have material difference to their trade deficit figures.

For Indian markets in calendar year 2014, a couple of domestic events will be the key deciding factor apart from the global events like the FED action and the Euro-zone economic recovery.

First would well be the General Election likely to be held in May’2014. A strong and stable government is the desired outcome. BJP coming with full majority will be the ideal one for the market and the economic recovery. A coalition government will be the biggest risk to economic recovery and hence market will dislike and drive down the market on this outcome. Generally early stages of any economic recovery or a emerging bull market coincides with political uncertainty, high NPA’s in the banking system, weak currency, high inflation and low retail appetite for investing in stock market. This time it’s nothing different. Though the election impact has had major short term gyrations but they haven’t predicted the course of economy or the market in any meaningful way. During the P. V. Narshima Rao regime, some of the finest reforms were laid down and economy was liberalized and that was the time of a unstable coalition government. Market was knocked down sharply when NDA went out of power in 2004 but during the UPA-I regime we saw one of the finest spell of Indian economy and the equity market. When UPA-II regime got re-elected market was locked in upper circuit and we saw one of the worst performance of the economy and the market and also big time scams got un-earthed during this regime.

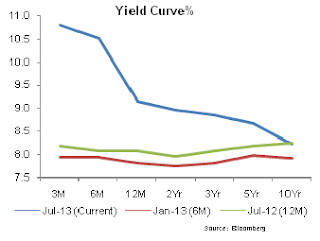

Second, would be the Inflation factor. Inflation remains elevated for a long time and the driving force to reckon with is the primary article inflation. Manufacturing inflation trajectory remains quite low and well below the comfort zone of RBI. It’s the food inflation which makes the overall WPI looks bloated and CPI remains elevated because of the major weight of food inflation in it. So in that sense, a better monsoon would do well to inflation and drive down interest rates which will then have a cascading impact on the investments and other moving parts of the economy. Expectation is for a declining trend in inflation mid-year and at present it seems to be peaking out.

Third would be the supply of papers with primary market comming with supply of papers worth USD 6 billion in first half of the calendar year 2014.

Outperforming Theme for 2014

First half of 2014 will be highly volatile for obvious reasons like the legislative election, expectation of monsoon and tapering effect of US Federal Reserve. But the yearend will be 7000 plus in Nifty, on back of growth returning, interest rates coming lower and inflation remaining benign. Serious outperformance of the market hinges upon the legislative election results and monsoon. At present if we look Nifty as a absolute number, index may look too high but from a valuation standpoint, we are trading at 14 times one year forward p/e and other valuation metrics like the p/b, dividend yield and earning yield to bond yield ratio, Nifty is trading below its long-term average multiples and hence remains undervalued. Expansion of valuation metrics will be the key driving force and those will come back once the companies start delivering growth at 15% plus i.e., above the average nominal GDP growth potential.

We think Information Technology, financials (on interest rates coming lower and economy picking up) and beaten down infrastructure stocks (to add beta to the portfolio since they are down significantly from their peak) will be the biggest outperformer for calendar year 2014. IT seems to be the most confident of all and is completely insulated from vagaries of domestic turbulences if any. We think that with US growth coming back will benefit IT companies the most. As the discretion spending power comes back with the multinational companies on better growth prospect, IT spend by the companies will rise and pricing power will come back for Indian companies. Along with it, INR settling at newer levels is an added boon to the IT companies. If incase any untoward political and economic development happens in the domestic space (whether it is political uncertainty, or lack of reforms, or tapering of bond purchase programme leading to flight of capital and risk averse) the direct impact will be the weakening of INR which will benefit IT companies the most. So, US growth picking up will lead to increasing business volume along with operational efficiencies and uncertainty in domestic market if any will lead to weakening of INR which will again be beneficial for IT companies. More importantly along with all these factors, IT companies across the sector is reasonably valued hence gives you ample amount of margin of safety. Infosys looks to be the star performer for calendar year 2014. In the midcap space NIIT Technology and Zensar Technology looks promising. Other stocks we choose for this year are FDC Ltd and Bajaj Finserve.