Market

seems to be in a roller-coaster ride with swings on either side getting wild.

The rise which we witnessed in the month of September was fast and furious and

was equally sharp as the decline prior to the rise. Monetary policy these days

have been seriously impacting market direction. Post, the induction of new RBI

Governor, Raghuram Rajan and his first day formal speech triggered a sense of

optimism and the markets flared up on the announcements. The key announcement

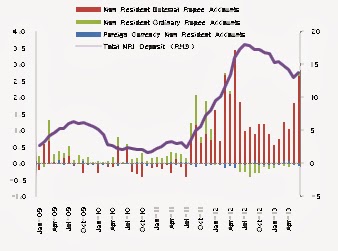

was with the FCNR-B (Foreign Currency Non-Resident) bank deposit scheme where

the dollar deposit will be hedged by RBI with swap line fixed at a concessional

rate of 3.5% p. a. for three years or more. This is almost half of one year

forward rates to hedge the currency inflow. Add to it the interest rate

provided in the FCNR deposit of 4.5% to 5.5%. The effective cost of funds for

banks comes around 8.5% to 9% and this does not requires SLR and CRR. Hence,

they can lend this new source of fund at 11% plus and hence a lucrative

proposing which will propel dollar-carry trade. FCNR deposit is estimated to

flock in hoards and many of the bankers are expecting fund flow in range of $10

billion to $20 billion in few weeks as the window remains open till 30th

November 2013. Reasons for non-resident Indians to put money in FCNR deposit

account is because of lucrative returns through leverage which is significantly

higher than the interest return generated in developed countries. This was the

real trigger, apart from the optimism of an experienced and learned personality

like Raghuram Rajan coupled with measures of FCNR deposit and OMC dollar swap,

which led the INR mark a bottom around the 70 mark and retrace back swiftly. Equity market also around that time marked an intermittent bottom around the 5118 mark

in Nifty. After it, Fed Chairman Ben Bernanke’s decision of not tapering

the bond buying programme of $85billion, because of sub-par growth, low

inflation, slowing consumer spending and weaker job market, led to market

opening gap up and kissing the 6000 mark in Nifty in an extremely euphoric

state.

The

RBI policy recently announced was a true shocker with the repo rate hiked by 25

bps to 7.50%. On the other side there was a rollback of its currency

stabilization measure. The Marginal Standing Facility (MSF) which stood at

10.25% now has been rolled back by 75 bps and stands at 9.50%. At present

majority of the banks is borrowing money at the MSF facility which is capped at 2.5% of NDTL, over and above

their requirement of 0.50% of NDTL(Net Demand and Time Liability) from repo window under the LAF(Liquidity Adjustment Facility). It is important to note that the 25 bps hike

in repo rate can be construed that the new RBI Governor is more targeted to

control inflation rather than support growth for macro-economic stability. It sees continuing sluggishness in industrial activity and

services. The pace of new project announcements have slowed and consumption is

weakening, including the rural areas. Consequently, according to the RBI,

growth is trailing below potential. Looking ahead, it believes that brighter

prospects for agriculture, an upturn in exports, and implementation of

infrastructure projects expedited by the Cabinet Committee on Investments (CCI)

will support growth in the second half of the fiscal year. For spurring growth

it is left best at the hand of the government policies for fiscal and

structural reforms. With higher rate decision by the RBI, it also intends to

support the INR by keeping the hope alive for dollar-carry trade and interest

rate arbitrage. This probably will support dollar flows into Indian shores and

thereby aid the current account deficit. But the higher interest rate regime

impedes growth and also raises the risk of corporate defaults for companies

which are highly debt laden. Report indicates that the corporate default will

rise to 4.5% in comparison to around 0.50% three years back. Moreover, it’s

clearly evident from the fact that Non-Performing Assets of banks rising to

above 10% (NPA+Restructured Assets) are a precursor to the ailing health of

Corporate India. If we look at the Corporate Debt Restructuring (CDR) cell

numbers, the stress in the banking system is elevated. Total of 14 cases have

been referred to the CDR cell in the first two months of the second quarter

amounting to Rs. 26,000 cr. And the fact remains that CDR cell cases accounts

only 30% of the total restructuring which happens outside the purview of the

CDR cell. Second interesting thing to note for the banks is their

credit/deposit ratio which remains elevated at 78%. It indicates that the banks

don’t have any other choice except to hike deposit rates and garner more

deposit. Credit growth though have moderated but still remains higher than the

deposit growth and hence banks would be seeking for hiking base rate so as to

adjust with the new cost of funds.

* RHS & LHS in Rs Billion

With the policy stance being taken by RBI, (OMC dollar

swap, FCNR deposit swap fixed at 3.5%, increase in foreign debt ceiling and

gold import curbs) it has stabilized INR. But the hike in repo rate by 25 bps

will certainly mark down the Sensex earnings estimates. Though the earnings of

companies related to good monsoon will certainly be reflected in selected

companies but the sticky inflation situation, rise in input cost, slowing down

of industrial activities and overall anemic economic growth and capex showing

no signs of green shoots are going to weigh down heavily on corporate earnings

and a downgrade risk in corporate earning persists. So our sense is that the

rallies in the equity market are more to do with liquidity flows (likely to

remain robust because of FCNR-B deposit scheme with swap line with RBI at

concessional rates till 30th Nov 2013) and global developments. With

certain major developments like the FCNR deposit, OMC dollar swap, and interest

rate differential will certainly keep the foreign fund flows on robust ground

and support the market which is more of technical in nature rather than any

significant fundamental changes. One year forward P/E of Sensex stands at 14

times, which looks reasonable and mean reversion trade seems to be the

practical conclusion. Though earning downgrade may make the P/E looks bloated.

Tactically, positioning on the long side with well chosen cyclical when the

market falls more than 10% and again seeking defensives when the market rises

more than 10% is the contra-trading

strategy worth applying. Geopolitical tensions with Syria is overblown

and hence crude may cool down in coming months which would be a potential

trigger for the market to scale back to 6300 in Nifty, since the whole

macro-economic dynamics of India changes along with it.