Theory of Dividends in Value

Investing:

Dividend season is in full throttle

and probably one could base their investment decision on the basis of dividend

yield in times when the precarious economic situation and general business conditions

are challenged. Because it is in times like this when the business with some

sort of competitive advantage and pricing power generally sail through smoothly

and dividend for these companies doesn’t gets compromised even during tough

times. Though the stock valuation may look depressive because of slowing down

of earning growth for extraordinary businesses but the dividend and its yields

looks more promising. The classical value investment talks about the intrinsic

worth of a business is its present value of all cash flows or the dividend

discount model talks about the present value of all future dividends (DDM)

which remains applicable in a limited context. But, the fact of the matter is

whether it is the investment in bonds or equities, what we can get out of the

bond as interest and dividend from equity is the actual return for our

principal. And here is the context in which dividend yield comes into play for

value investing or for taking proper investment decisions. Difference between

investment in fixed income and equities hinges upon the fact that a dividend

growth adds on to the yields in the long run and the dividend yield can surpass

the bond yield in a meaningful way. But the real context of the difference

between equity and fixed income return comes into play when it is permanent

investment, not speculative trading, and dividend for years to come, not income

for the moment only. For permanent investments into equity market, a stock is

worth only what you can get out of it i.e., Dividend.

Experience shows that companies with a

competitive moat generally are more liberal with paying dividend out of

earnings. The real issue is with the reinvestment of earnings. As the adage

goes for certain management that earnings or majority of earnings is required

to be reinvested so as aid to tremendous growth potential in the business

environment or to keep abreast with its competitive position. But greater

experience shows that capex heavy business tends to reinvest majority of

earnings and the reinvested capital generally doesn’t bring in greater return

on reinvested capital and hence in the process brings in subpar equity return.

Majority of the capex heavy businesses tends to reinvest their earnings just to

maintain their fixed assets and incremental value addition i.e, in the process Earning

Value Added (EVA= RoE-WACC) spread gets eroded significantly. The real crux of

the matter is whether the company increases dividend paying power with the

reinvested earnings. Companies who can generate return much higher than the

Weighted Average Cost of Capital (WACC) with their incremental investments will

generate higher equity value in future. If the incremental capital could not

generate returns higher than the WACC, it clearly reflects the saturation in

the growth dynamics of the business segment and hence it is always prudent in

that case to give away as dividend to shareholders (after retaining some to

maintain the existing fixed assets) or increase the share of dividends in

earnings since the reinvested capital could not add materially to the existing

extraordinary return on capital and rather ends up diluting it.

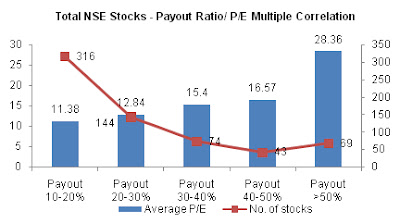

The actual reason for discussing the

dividend paying power is the fact that companies with consistent higher

dividend payout generally tends to command higher valuation or higher p/e

multiples and are also good wealth creators in the long run & the mathematical calculation is given as follows…

Price (Dividend

Discount Model) = Dividend/ k-g

Where

k=required rate of return i.e, cost of capital; g= dividend growth to

perpetuity

The

price-earnings ratio for any stock is….

P/E= Price/

Earnings:

Or Price = P/E * Earnings

Substituting

for Price = Dividend/k-g

Or P/E * Earnings = Dividend/k-g

Or P/E = Dividend/(Earnings *k-g)

Or P/E =

Dividend Payout/ k-g

(Dividend

Payout Ratio = Dividend/Earnings)

Or k-g =

Dividend Payout/P/E…………….(1)

For, Dividend

Yield = Dividend/ Price

Or Dividend

Yield = Dividend/(Earning*P/E)

Or Dividend

Yield = Dividend Payout/P/E……………(2)

or P/E =

Dividend Payout/Dividend Yield

Combining

both (1&2)

k- g =

Dividend Yield and K = g + Dividend Yield

*Hence, it

can be concluded that P/E multiple is a positive function of consistent

dividend payout ratio and growth and higher dividend payout ratio commands

higher P/E multiple.

*Return is a

positive function of Growth and Dividend Yield

Companies

screened on the basis of higher Dividend Payout and ROE delivering strong CAGR shareholders return over last 10 years:

|

Sl.no

|

Company

|

Payout

%

|

Payout

avg %

|

ROE

%

|

ROE

avg %

|

P/E

|

Dividend

Yield

|

P/B

|

|

1

|

Colgate-Palm.

|

69.84

|

87.03

|

158.62

|

95.52

|

45.71

|

2.24

|

60.09

|

|

2

|

Hind. Unilever

|

63.89

|

80.46

|

86.86

|

86.44

|

35.76

|

1.93

|

32.02

|

|

3

|

Glaxosmit Pharma

|

85.62

|

72.81

|

33.34

|

31.01

|

50.94

|

1.25

|

16.35

|

|

4

|

ITC

|

61.18

|

63.21

|

35.08

|

29.73

|

31.16

|

1.89

|

10.8

|

|

5

|

VST Inds.

|

85.27

|

62.29

|

25.59

|

29.00

|

17.57

|

4.95

|

8.46

|

|

6

|

ALSTOM India

|

39.43

|

54.02

|

26.51

|

32.08

|

20.77

|

1.11

|

3.87

|

|

7

|

Britannia Inds.

|

55.40

|

53.36

|

54.02

|

30.04

|

28.29

|

1.5

|

12.41

|

|

8

|

Godrej Consumer

|

21.58

|

48.42

|

25.65

|

67.87

|

32.02

|

0.9

|

7.25

|

|

9

|

CRISIL

|

55.59

|

47.45

|

46.55

|

42.93

|

21.64

|

2.18

|

9.59

|

|

10

|

Navneet Publicat

|

45.96

|

46.80

|

22.77

|

22.89

|

11.77

|

3.45

|

3.06

|

|

11

|

Sun TV Network

|

60.18

|

43.94

|

28.30

|

28.26

|

19.97

|

2.48

|

5.33

|

|

12

|

ACC

|

58.76

|

42.28

|

16.98

|

23.73

|

14.36

|

2.76

|

2.54

|

|

13

|

Dabur India

|

38.85

|

40.37

|

41.36

|

53.08

|

29.35

|

1.25

|

10.23

|

|

14

|

Asian Paints

|

40.04

|

39.76

|

39.39

|

43.03

|

34.73

|

1.21

|

11.44

|

|

15

|

HCL Tech

|

36.23

|

39.09

|

27.74

|

27.49

|

12.56

|

1.8

|

3.17

|

|

16

|

TCS

|

32.30

|

38.44

|

40.58

|

41.08

|

18.78

|

1.76

|

5.84

|

|

17

|

Supreme Inds.

|

34.64

|

37.33

|

37.43

|

31.61

|

13.37

|

2.48

|

4.18

|

|

18

|

O N G C

|

30.82

|

35.83

|

22.21

|

23.75

|

9.64

|

3.34

|

1.69

|

|

19

|

Emami

|

50.57

|

35.80

|

37.06

|

35.90

|

30.16

|

1.24

|

11.56

|

|

20

|

Ambuja Cem.

|

46.16

|

34.87

|

16.92

|

20.31

|

14.1

|

2.4

|

2.57

|

|

21

|

Infosys

|

26.72

|

34.48

|

27.20

|

31.51

|

13.97

|

2.1

|

2.95

|

|

22

|

ICRA

|

39.51

|

34.34

|

16.10

|

19.85

|

15.67

|

2.16

|

2.74

|

|

23

|

Balmer Lawrie

|

32.48

|

33.19

|

20.93

|

23.25

|

7.67

|

2.52

|

1.32

|

|

24

|

Pidilite Inds.

|

31.44

|

32.84

|

26.76

|

27.61

|

28.86

|

1.03

|

7.45

|

|

25

|

Kansai Nerolac

|

20.91

|

32.47

|

16.08

|

20.63

|

21.92

|

0.92

|

5

|

|

26

|

Thermax

|

22.03

|

31.93

|

25.24

|

32.31

|

19.29

|

1.32

|

3.29

|

|

27

|

GAIL (India)

|

26.14

|

30.60

|

18.47

|

20.32

|

8.73

|

2.94

|

1.26

|

|

28

|

Tata Chemicals

|

26.13

|

29.60

|

16.34

|

18.49

|

8.4

|

3.52

|

1.05

|

|

29

|

FDC

|

28.55

|

27.96

|

20.46

|

22.88

|

10.41

|

2.54

|

2.04

|

|

30

|

Coromandel Inter

|

32.83

|

27.90

|

29.02

|

35.61

|

10.08

|

3.22

|

2.07

|

|

31

|

Titan Inds.

|

26.96

|

26.35

|

48.19

|

40.64

|

30.73

|

1.02

|

10.43

|

|

32

|

Godfrey Phillips

|

23.87

|

24.35

|

20.77

|

18.86

|

19.69

|

1.24

|

3.17

|

|

33

|

M & M Financial

|

23.52

|

23.97

|

23.07

|

19.85

|

13.35

|

1.41

|

2.53

|

|

34

|

Container Corpn.

|

25.81

|

23.89

|

16.50

|

21.59

|

14.51

|

1.67

|

2.1

|

|

35

|

Bharat Electron

|

20.29

|

20.60

|

15.33

|

21.66

|

11.64

|

2.04

|

1.45

|

* The index

(CNX 500) is screened on the basis of following criteria:

- Payout ratio greater than 20% for last 10 years.

- ROE greater than 15% for last 10 years.

- Average Payout Ratio and Average ROE is calculated since 2007.

- Payout and ROE is taken for FY13.

- P/E, Dividend Yield and P/B is taken for FY14.

Paras Bothra

+919831070777

No comments:

Post a Comment